Go to article

October 15, 2012 33 Comments

As my focus has evolved to getting companies to imagine and execute incredible digital marketing initiatives, I've discovered that my passion for the medium, my experience in creating innovative solutions, and — yes — my charm are sometimes insufficient to convince some CxOs to take their digital marketing opportunities seriously.

As my focus has evolved to getting companies to imagine and execute incredible digital marketing initiatives, I've discovered that my passion for the medium, my experience in creating innovative solutions, and — yes — my charm are sometimes insufficient to convince some CxOs to take their digital marketing opportunities seriously.

Rather I've had to fall back on my trusty steed: data. :)

One common scenario is this: Company PJ spends $250 million on traditional advertising. They know the web is exciting. They have a Facebook page. They have a smattering of microsites that their Agency put together once in a campaign rush a number of years ago. But they are just scratching the surface of what's possible.

My goal is to get them excited about creating an amazing digital acquisition strategy that delivers noteworthy experiences through their owned digital platforms, and which ultimately delivers bigger profits (usually offline, but online as well).

The question they'll ask: But how do we know our $250,000 investment in digital (ads plus sites/apps) will drive offline sales?

There are other scenarios, there are other questions. But the crux of it all is: Prove it.

Prove it that my customers use the web. Prove it that they talk about me on social sites. Prove it that my competitors are better than me. Prove it that you're not just pushing me into an alligator-filled swamp.

My approach to the prove it question has always been:

"Look, it is insanely cheap to fail on the web. It takes little money – comparatively – to try a new advertising medium, or improve your website, or build a mobile app, or try just about anything else. So why look at what the 'benchmarks' say? Let's take a tiny portion of the budget, try things live, learn for our business, and win over time."

Summary: Just do it.

But this is not how many CxOs view things. The cost of failure in the offline world is so high that even when the cost of failure is low (online), they don't want to take the smallest risk.

So, rather than evangelize on faith (why is faith never enough?), I've started to rely on research to show broad consumer behavior, influence and outcomes. This provides our executives with some peace of mind, creates a sense of urgency, makes them feel reassured, and helps give them context to make new types of decisions.

The challenge is that it is hard to get at this market research, as it is squirreled away in lock boxes (remember Al Gore?). Or with analysis firms, who often take a"fill out our lead gen form to get a three-page preview and then we'll bug you to give us $500 to get the whole thing" strategy.

Turns out there is another option, from IAB/TNS/Google, of which I was, shamefully, not aware.

The Solution: Consumer Barometer

Consumer Barometer provides qualitative research, for free, that will allow you to analyze digital's influence and consumer behavior that leads to online and offline purchases!

For me it has been a boon when it comes to scenarios like the ones mentioned above, where I need data to help companies around the world get the context they need to create smarter digital strategies.

Consumer Barometer was created by IAB Europe with TNS Infratest and Google as partners. It is a repository of global data that has as its primary purpose to quantify the role of digital in the consumer journey from research to purchase.

Note: The IAB (Interactive Advertising Bureau) and Google both benefit in their own way from the use of digital platforms. TNS, among other things, offers qualitative research services, this tool showcases their work and so in a long shot way they benefit from it. You should be aware of it. Even if, as will be amply obvious below, the data is not meant to show data in one light or the other. That also applies to the consumer Search behavior (#4 below) which includes all search engines and not just Google.

Please visit the about page to learn more about the data collection methodology, sample sizes, and the Enumeration study to ensure results are representative, and to download the detailed questionnaires used for each study.

The data was collected in the first part of 2012, between January and May for the Barometer and between January and February for the Enumeration.

The Analysis: Four Insightful Options

Let's spend some time learning how to use the tool and really internalize why it is so awesome.

The Barometer answers four basic questions:

Let's look at them individually. Even if you don't use the Consumer Barometer, my hope is that you'll perform the analyses below using the qualitative research tool of your choice.

This section provides a macro summary of how many people have access to the web, how they access the web, mobile device penetration, plus two really, really cool things: Psychographic segmentation and mobile device "intent to purchase."

Let's look at the actual data by comparing USA and Russia. (Click on the link to go directly to the report, and create your own country combinations.)

Pretty cool context, right? Before you start influencing someone about the power of the web, it is nice to have a handy dandy chart to show that the web is material.

I spend 70% of my time in the US and for those discussions I'm primary looking at speed (connection above), mobile penetration (yes, 2007 was the year of mobile!), and mobile intent to purchase (I love this data).

But during the 30% of the time that I spend outside the US (or on global brand strategy), the other column and the contrasts you can draw are very meaningful. For example, if you are in Russia and an ecommerce business, it is even more important to have a well thought out mobile strategy. Just look at the intent numbers (and compare then to the US).

These two numbers give you macro context about the web. The part on the right gives you psychographic type segmentation of who is actually using the web, and why…

Five segments: Functionals, Aspirers, Knowledge Seekers, Communicators, Influencers, Networkers.

Just click on the question mark icon to see the detailed definitions. Or visit TNS Digital Lifestyles.

Here's the one for Functionals: The internet is a functional tool, I don’t want to express myself online. I like emailing, checking the news, sport & weather but also online shopping. I’m really not interested in running my social life online and I am worried about data privacy and security. I am older and have been using the internet for a long time.

And to think you've been pimping social media on every company you can find. :)

I look at the company I'm working with, their branding and direct response strategies, analyze psychographic segmentation of the internet audience and then create my recommendations for the about their overall digital opportunity.

In Russia, that would mean figuring out how to be "communicators first." And imagine how powerful it would be to show this data when you are talking to a CPG client or a branding oriented client.

This data is often helpful in understanding subtle differences.

For example, from the outside Sweden and Norway are practically one and the same. (Please no hate letters, I know they are not! :)). When you look at the data, your mobile strategy will be a bit more tablet-heavy in Norway (stronger penetration, stronger commercial intent) and your advertising targeting, tone and approach will cater to "knowledge seekers in Norway and to "functionals" in Sweden.

There are other differences as well that you'll account for, but this gets you the macro context within which you can start thinking about your digital marketing strategy.

In the above report we got a hint of commercial (purchase) intent for mobile platforms.

This report allows us to dive deeper for a product (say cars), to see where people buy (online or offline), where they research (online overall and search engines specifically), and how many do mobile research before purchasing.

So how many people buy cars online, and what is the influence of digital research and mobile platforms? Let's compare USA and Czech Republic …

9% of the roughly 17 million cars sold in the US were purchased online. Did you think the number was that big? I was surprised. But there you have it. Data.

41% of all car-buyers (regardless of where they purchased) used a search engine to research before buying. As an automotive manufacturer, dealer or slick salesman, this helps you to internalize the importance of Bing, Yandex, Baidu and other search engines (rank or miss out!).

58% of the buyers did online research of some kind. Again, this gives you a sense for how many people might be making up their minds, or coming very close to that state, prior to walking into your showroom. Or if you are GM/Nissan/Jaguar you get a sense for how many people will not even visit your showroom, because they make up their mind online (including on your site) and go to their chosen car dealer for the test drive and non-haggle purchase.

You are either online, discoverable and awesome, or you are on the losing side (ok, not necessarily the losing side, but fighting for the shrinking 42% that do no online research).

Data is cool, right?

And how impressed are you with Czech citizens? As a lover of digital platforms (there I said it), I'm delighted that 93% research online, 80% use search engines, and more of them buy cars online than in the good old USA! I love you Czech Republic!

Now if you are Tatra, MTX or Praga, you know how critical your digital strategy. Use the data above in conjunction with your offline data, the macro-economic conditions and your objectives to ensure your marketing is reflective of the on the ground consumer purchase journey.

You can do this analysis for a whole variety of products. Finance, real estate, groceries, media, retail, technology, travel and health products …

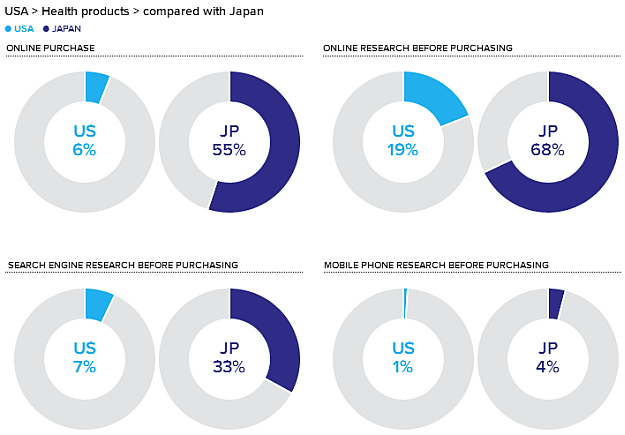

What is going on in Japan with health products?! :)

Differences between countries and audiences are pretty stark across the world and you would be wise to adjust your strategy accordingly based on surprises in the data.

You would use this data to get a broad understanding of where consumers are and the impact of digital and mobile on their purchase experiences.

This provides strategic context within which to set your online and offline marketing and customer engagement strategies.

We dive deeper into the data, from just looking at online research and online purchases to marrying that with all types of research and offline purchases.

This report shows you several delightful info snacks. Let's analyze the multichannel research and purchase behavior of book buyers in the US.

Amazingly, 57% of book purchases seem to be offline. That is a surprise, it is not? (Given the fact that Amazon is dominant and Borders is dead.)

The next layer shows you where consumers did research. Online was the biggest, not surprising. You might be just as shocked as I'm that 40% of the people did not research before making a purchase!

With books, just 14% of the people used both online and offline channels. Keep an eye on this number as you pull the data for your product category/country. Multi-channel still forms a huge influencing factor, context you want to have as you decide your online and offline strategies.

I love the last set of information. You get three drop downs. "Started Research With," "Generally Used," And "Most Important in Driving Final Purchase Decision."

My favorites are “started with” and “most important.” When you put them together, like above, you can think about the complex consumer journey and which channel plays the introducer role and which plays the converter role. Think of it as attribution modeling. :)

For books, word of mouth kicks off the consideration process, but retailers, publishers and other websites still play a massive role in final conversion (for example, online reviews). Advertising is #5 at introducing, but #10 at converting (illustrates the disruptive nature of the massive amounts of information at our finger tips).

You are also able to filter all the above data by: Gender, Age, Education and Internet Usage.

Really cool data, try it for your product or service and apply it to your largest country.

In this report you also get this lovely visual:

It is a little complicated, but stick with me.

It is a little complicated, but stick with me.

25% of people researched online only before making a purchase online.

4% of people research online only before purchasing offline.

1% of people researched offline only before purchasing online (not really surprising, still quite low).

16% of people researched offline only before purchasing offline.

And so on and so forth.

So, if you were trying to figure out who your online-only campaigns are targeting, or your offline-only campaigns are reaching, now you know.

At the very bottom you see that 29% of people didn't do research before purchasing offline, and an amazing 11% of the people who were online did not do any research before buying online!

When you connect this data with the information above, you get a richly textured understanding of the dynamics of your business.

You don't have to rely on what your HiPPO feels in his heart, or what the young marketer just back from a stint at Google or Facebook thinks.

You actually have the data you need to understand what is happening in the real world, data that can help you make smarter strategic decisions.

As in the first two cases you can run this analysis for different countries to compare and contrast (if you are a multi-national company):

(Click on the image above for a higher resolution version.)

Canadians love offline a lot more than you might think. Still. For hotel stays! (Come on Canada! Why you no go digital already! :))

Notice the other nuances: Search and Product Comparison Sites are relatively more important in Canada than in the US. Adapt your strategy.

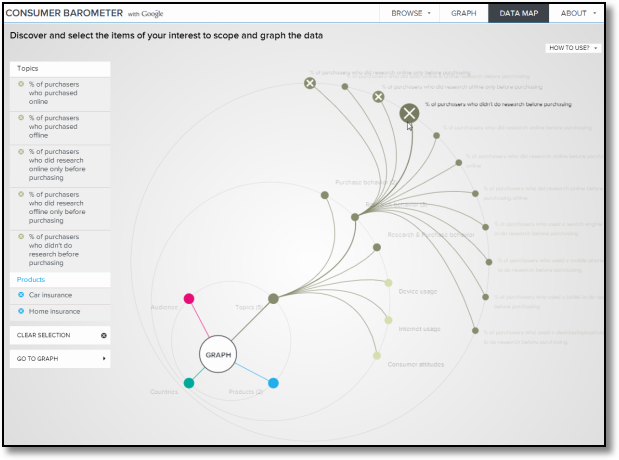

You can also use the Data Map interface on the top nav of the Barometer to create really customized bar charts (in case you don't like all of the sexiness going on with the ones above). Just click on Data Map. You'll see four colored circles. Click on each to make your selections, like so where I'm choosing the car and home insurance categories …

The click on the other element you are interested in and click your mouse a few times. For the insurance business I'm interested in knowing the % of purchases online and offline, and people who either researched online one, offline only or did not research at all. I would choose those in the green circle cool flowing thingy…

Press "Go To Graph" and … boom!

[In an otherwise excellent tool I must admit that I don't like the visual layout in this bar chart view. You can have as many as 20 elements per category. How did the designers expect us to keep track of the elements using shades of blue!]

The first two bars show how much of the insurance business is still offline in the world today (it varies a bit by country, but offline still leads in most countries).

Even if you work on these products, the third bar should show you why your digital existence (desktop or mobile) is so important. It is the lead influencing channel. As in another case above, online helps people decide, even when they convert offline.

This illustrates why it is so important not to obsess about your online conversion rate to justify the value of your digital efforts. Most of the outcomes may still be offline. It is SUPER important to passionately measure the offline impact of your online efforts until the day you die (cue, dramatic music).

All this might seem like a lot of analysis/work. It is an intense amount of effort. But like all strategic analysis, you'll do this only periodically when it is time to work with your CxO to 1. check that your multi-channel marketing strategy takes into account current consumer behavior (no point in betting it all online if online is not where customers are) and 2. create new and innovative strategies to reach consumers and engage with them.

So a lot of work, likely every six months, to have a big impact on your overall business. Totally worth it!

This analysis helps us understand the role of search in the consumer purchase journey.

The data is for all search engines, not Google-specific. As you look across countries, circle back to the percentage of consumer usage of search engines in those countries. So when I'm looking at Russia, the search influence is that of Yandex, the leading engine in Russia. In the UK, it is likely Google. So on and so forth.

Getting the data is a simple two-step process.

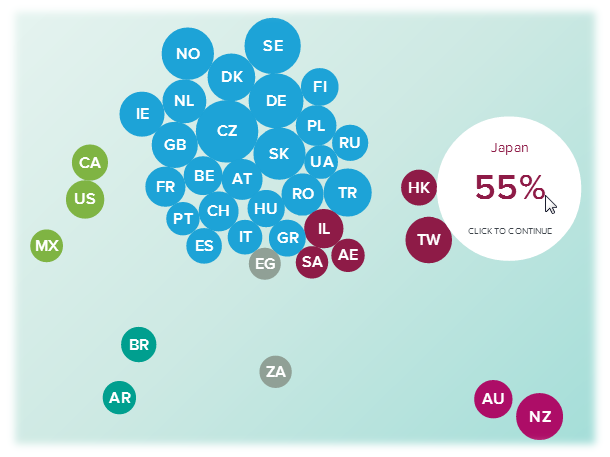

First, look at the country view, the bubbles show at a glance more or less usage in research prior to purchase…

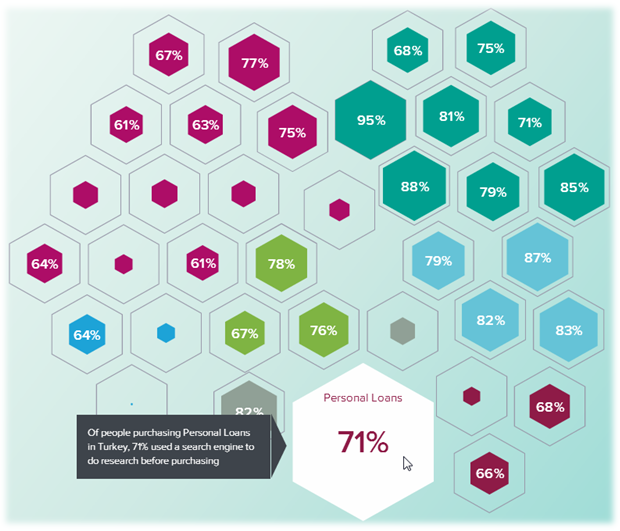

Let's choose Turkey because I've always wanted to go there (perhaps they are hiring a digital evangelist?) and then click on the bubble to get the detailed data …

You simply hover your mouse over the category you are interested in and you'll get data on people who used a search usage to do research prior to purchase (online or offline).

The lowest impact of a search engine is in the groceries category (I wonder why? :)), and the highest, in Turkey, is in the computer hardware category.

As you try to figure out how much value to put on search in your category/country, you can use this analysis to move beyond the hype/guesses and use actual data to help influence your decisions.

Closing Thoughts.

Remember that this is qualitative research data. Focus more on the contrasts between the numbers and patterns across countries, and less on the actual specific number.

Please read the about page, especially the data and interpretation section.

Also remember that this data is most useful as critical context for strategic decisions about your multi-channel consumer influence, digital and real world marketing, and conversion strategy.

I've not really done deep-dives into gender, age or income impacts on research or purchase preferences. This data is available in all the reports, please do explore that for your business as relevant.

You can also plot a lot of data by continents.

I wish we had trends, at least year-over-year, for this data. We don't. What you see is for 2012. I hope TNS/IAB/Google will update the tool to give us trends.

Finally, while I've chosen to focus on the tool itself, there are many wonderful data visualization lessons embedded in the tool. I hope you'll take a step away from the analysis and reflect on the visualizations you are seeing and find inspiration. I've applied lessons from Consumer Barometer to my reports and dashboards.

Action Items.

Regardless of the size of your business, use the four sets of analysis in this post to ensure you:

1. Understand the consumer journey

2. Identify the mobile purchase intent in your category

3. Leverage the channels that start the consideration journey and the channels that are most influential in the final decision

4. Drive overall business outcomes by combining online and offline consumer touch points optimally

5. Monetize the role of search engines in the consumer journey and

6. Identify the dominant personas (Functionals, Aspirers, Knowledge Seekers, Communicators, Influencers, Networkers) in your category and ensure your marketing messaging and digital experience is talking to the right persona.

2. Identify the mobile purchase intent in your category

3. Leverage the channels that start the consideration journey and the channels that are most influential in the final decision

4. Drive overall business outcomes by combining online and offline consumer touch points optimally

5. Monetize the role of search engines in the consumer journey and

6. Identify the dominant personas (Functionals, Aspirers, Knowledge Seekers, Communicators, Influencers, Networkers) in your category and ensure your marketing messaging and digital experience is talking to the right persona.

Six simple, exciting, action items.

Strategic analysis rocks!

As always, it is your turn now.

Do you have a favorite tool for doing this type of analysis? What challenges have you faced in getting good multichannel qualitative research? Of the above four questions, which one would be most insightful for your business? What's a question you've always wanted answered via qualitative research? If you've used Consumer Barometer, is there a trend or insight that you've discovered that was odd/delightful/surprising?

I welcome your insights, concerns, delightful stories and questions via the comments form at the end of this post.

Thank you.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.